-

Market Returns and Regression Betas →

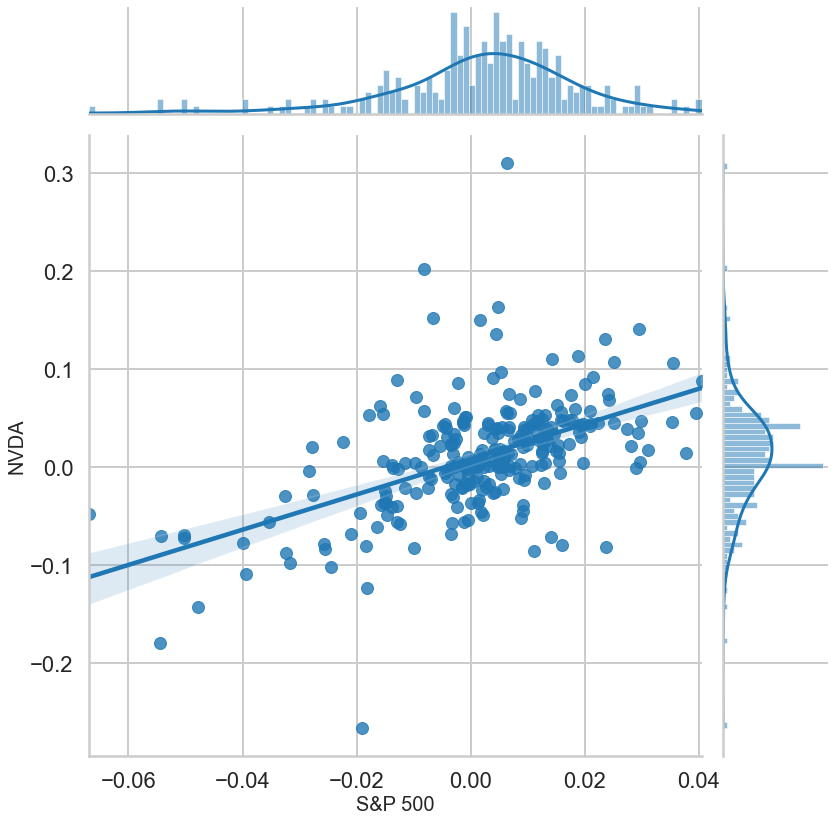

In a previous post we saw how volatile a stock is, compared to a broader market performance, by plotting the percentage change in weekly returns of the stock prices. We were able to visually see that a certain stock was moving much more vigorously than the market (S&P 500 in that case).

In this post, I want to see how to find and measure the movement of a particular stock with respect to the market. Is there a standardized measure? Suppose an investor who holds multiple assets wants to measure how much risk a particular asset adds to his portfolio, is there a way he can quantify the risk?

Statistically, covariance of an asset measures how much the asset moves compared to market movements

Beta is a standardized measure of this covariance.

covariance of asset with market Beta = --------------------------------- variance of the marketSince we have market returns data that we used in our previous plot, we can run a regression on this data and try to fit a straight line to the data points in our dataset. The slope of the regression is the Beta.

R_asset = alpha + beta * R_marketLet us use the statsmodels library to compute a linear regression.

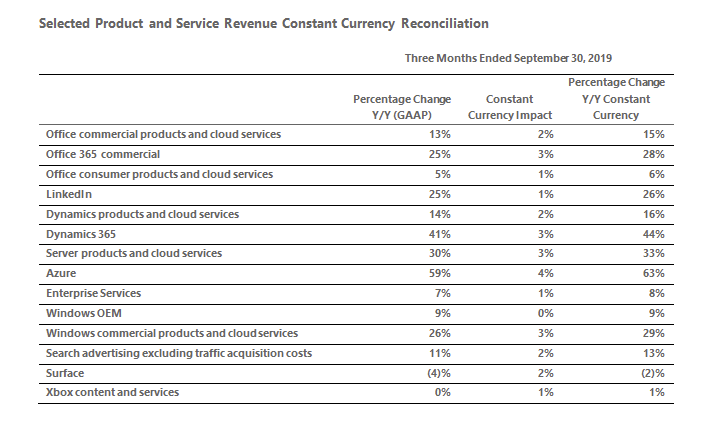

import statsmodels.api as sm ... x = sp500_returns y = nvda_returns x = sm.add_constant(x) nvda_reg = sm.OLS(endog=y, exog=x) nvda_reg_model = nvda_reg.fit() print(nvda_reg_model.summary())OLS Regression Results ============================================================================== Dep. Variable: Adj Close R-squared: 0.265 Model: OLS Adj. R-squared: 0.262 Method: Least Squares F-statistic: 93.11 Prob (F-statistic): 5.21e-19 Log-Likelihood: 414.26 No. Observations: 260 AIC: -824.5 Df Residuals: 258 BIC: -817.4 Df Model: 1 Covariance Type: nonrobust ============================================================================== coef std err t P>|t| [0.025 0.975] ------------------------------------------------------------------------------ const 0.0080 0.003 2.598 0.010 0.002 0.014 Adj Close 1.7961 0.186 9.649 0.000 1.430 2.163 ============================================================================== Omnibus: 73.992 Durbin-Watson: 2.085 Prob(Omnibus): 0.000 Jarque-Bera (JB): 639.151 Skew: 0.846 Prob(JB): 1.62e-139 Kurtosis: 10.492 Cond. No. 60.8 ============================================================================== Notes: [1] Standard Errors assume that the covariance matrix of the errors is correctly specified.Since we used (percentage change in ) adjusted closing prices in our returns (with the column name ‘Adj Close’ in our dataframe), we see that the beta of NVIDIA stock during the period of the regression (2015-2019) is

1.79. We also see the R-squared value of our regression which turns out to be 0.265 and this indicates that 26.5% of the risk can be attributed to the market risk while the remaining73.5%of the risk is firm specific. We also see the P value of our regression and a bunch of other details.We can also plot our regression:

p = sns.jointplot(x = sp500_returns, y = nvda_returns, kind = "reg", fit_reg=True, height = 20, marginal_kws = dict(bins=100)) ...

If you are an investor and you are given a choice between two stocks having the same beta but very different R-squared - which one would you choose and why?

-

Market Returns and Stock Prices →

I recently started learning about stock prices, market returns and how risk is measured. I am still in the process of learning about it and I hope to add more to my knowledge in the following months.

There are many stock indices to look for how the general market is performing. More often, we hear about DOW index (DJIA - Dow Jones Industrial Average) down or NASDAQ up and so on. But NASDAQ is a technology firm heavy listing - i.e. the movement of the NASDAQ index would indicate the movement of technology sector to a large extent. While DJIA is a more general mix of stocks, it is price weighted and so companies with a higher stock price or extreme price movements would influence the movement more. Another common index is the S&P 500 (Standard and Poor’s 500) Index. S&P 500 is weighted by market value of the companies rather than the stock prices. So, a 5% movement of a

$200stock would affect the index the same way as a 5% movement of a$100stock.Let us see how the weekly percentage change in returns of one of the stocks (NVDA) compares to the percentage returns of the S&P 500 returns (usually referred to as market returns), over a period of about five years.

... sp500_returns = sp500_df['Adj Close'].pct_change()[1:] nvda_returns = nvda_df['Adj Close'].pct_change()[1:] ... ... sp500_returns.plot(label='S&P 500') nvda_returns.plot(label='NVDA')The above plot shows you how much NVDA (NVIDIA stock prices) fluctuate more than the general market (S&P 500 price index). If the stock is too volatile, it might be because of some risk associated with that stock, some portion of which can be explained by market movements and some portion specific to the company’s internal risk. Beta is typically used as a measure of risk, which we will compute in a future post.

-

The Evolution of Search Advertising →

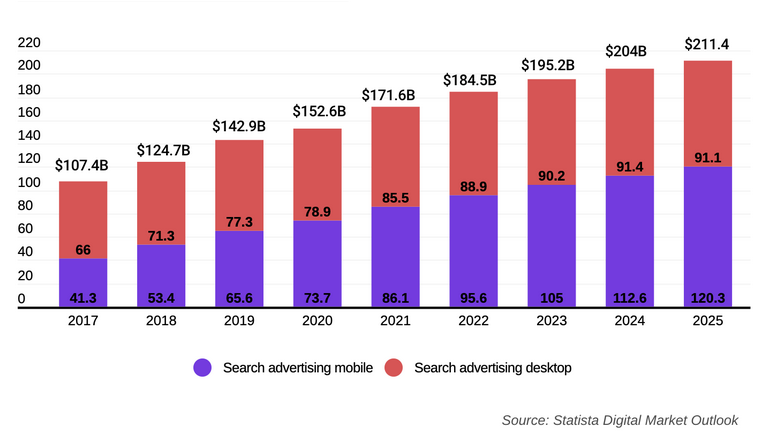

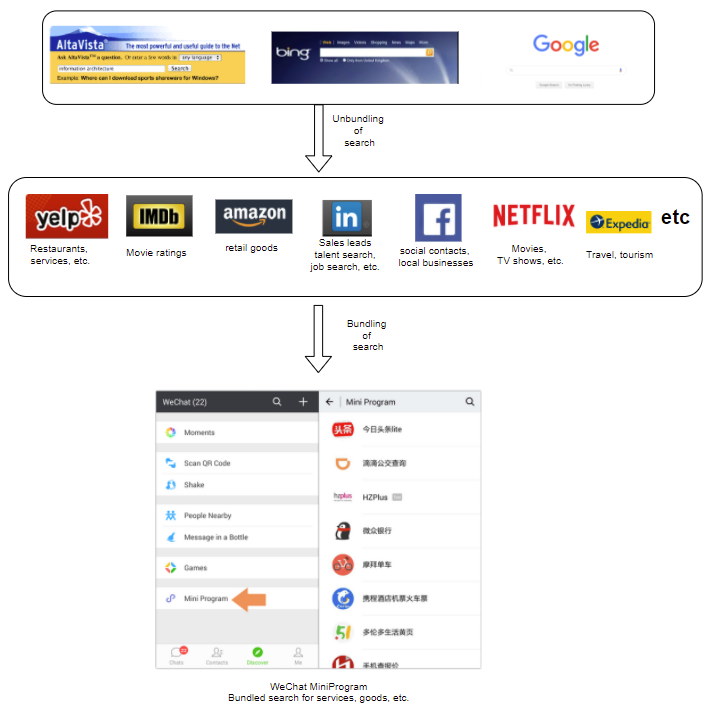

In a previous post, we saw how internet search evolved from being a generic search application to specialized ones. We also saw how there are also apps that provided bundled search experience but by being a gateway (or gatekeeper) to several specialized search services. With search advertising being one of the most lucrative business to be in, there are large implications from the experience, relevance and the quality of the search results.

The search experience and relevance of search results depends on what one is searching for and what extras go with the main search. Searching for a baseball game in a stadium has more likelihood with pizzas or dining places (to grab a bite on your way to the stadium or dine on way back home), while searching for a baseball game on TV goes well with doordash like home delivery or inviting friends over (via a social app). The geographical aspirations and interests that depend on age also matter a lot. Youngsters are more likely to search for fast-food while the elderly might search for baking needs and recipes. Youngsters might search for camping and youth hostels while others would want to visit museums and other historical sites while staying in hotels closer to the city. Youngsters might search for escape rooms while the elderly might look for concerts and plays. Of course, it is not as black and white as described and it is always a large spectrum of interests, age, location and cultural preferences.

Bundled and unbundled search has huge implications on the search advertising. Instead of advertising in one available avenue (a generic search engine), there are specific applications where one could do targeted advertising. I am very likely to search for a restaurant on Yelp, a movie rating on IMDB, books on Amazon, taxi service on Uber, take-away food on Doordash, etc. What this means is that some of the advertising dollars move away from Google to the specialized search apps. Further the data acquired by these specialized search apps may remain separate making them serve more relevant results and improve search experience. That is one of the reasons one searches for restaurant ratings in Yelp and a doormat’s rating on Amazon. While this might make us assume specialized apps might be the only way to go, all-in-one search apps like WeChat (MiniProgram) act as a gatekeeper to many of the services - in many cases the services can be accessed only through WeChat. This might allow such an app to aggregate user preferences from the different services, profile the interests and allow for cross-selling or upselling dynamic advertisements. Such an aggregation of data from the different services (from within an app) also allows to curate advertisements that would target the specific user’s interests. If he has consistently bought pizza take-out every Friday evening, Uber app could advertise pizza take-away stores on the user’s ride back home on Friday evening, and probably suggest some highly rated movies to watch along with eating his pizza. In the absence of such a nexus between the services, there could be other ways of stitching together the different pieces of information (like payment apps, GPS and mapping data, communication apps, etc.) to build a user profile. News feeds further complicate the search, by being more dynamic and real-time and sensitive to user preferences and interests.

This brings us to the discussion of privacy. How does one use the data in such a way that any individual information is not let out, without affecting the quality of the search results. Lately, privacy is a huge concern among technology companies and has hence renewed interest in the topic. Technologies for ensuring privacy without compromising search quality would be a topic of a future post.

-

The Evolution of Internet Search →

Over the last couple of decades, internet search has evolved a lot. This evolution has several facets - on one hand technology changes like Web 2.0, semantic web, richer media, etc., and on the other hand going from generic to specific - or unbundling and bundling of search.

In the early days of search engines, one would search every generic thing on the search engine application. If we want to see if there are good Pizzerias near our hotel during a trip to Paris, we would look for pizzerias in Paris and whichever fancy restaurant had made an effort to create a website (a static one) might show up. As technologies evolved and when we were able to interact more with the webpages (Javascript, PHP, CSS), one could also click on a dropdown menu and check out the price list of the pizzeria which might change seasonally, and of course several advertisement banners the show information about the baseball game happening nearby. One was also able to give feedback on the website for other visitors to see.

Fast forward to today, with the evolution of the so called So-Lo-Mo (for Social, Location, Mobile), we could search for pizzerias in a 5 km radius around 75014. And we do not even do it on Bing or Google, rather on a specific application like Yelp. Besides the list of pizzerias around 75014 (location), the app would also show us what different people liked in the pizzeria and their opinion (social). Further we do not need to search for a cyber-cafe or a dial-up network in the hotel room. We can use this application from a cellular phone (mobile) which has a GPS that allows us to pin-point our location on a map in case we get lost looking for the pizzeria.

From searching on one single generic search page, we have moved on to specific apps that provide specific search information. If we want to know how good is a movie, rather than asking Google, we go and check the rating for the movie in IMDB. If we want to watch an awesome movie starring Margot Robbie, you search in Netflix for movies Margot Robbie stars in and pick one. If you want to look for your school friend whom you lost touch with, you search for him in Facebook.

While the unbundled search started becoming more and more popular in the western world, in Asia the popular WeChat app started bundling it. More than calling it bundling, it severed as a gateway to searching many specialized goods and services from within the main search app. Many of these services (called MiniProgram) can be accessed only from within the WeChat app. One could think of WeChat as a mobile operating system within an app. All you want from a mobile operating system is a bunch of useful apps that serve your needs (unlike desktop operating system that has somewhat different set of characteristics) and WeChat provides exactly that. Lately, Facebook is trying to bundle more services (search, shopping, payment, etc.) into one.

What makes a great search experience? Everything bundled in one - which makes it simple to search or is it better to have specialized, standalone search applications - less clutter, more refined for what we are looking for? Many top product companies are confused about this very question. The answer is not going to be simple. No one method will ever become the dominant option and so many companies need to evaluate the markets where they want to grow or maintain dominance in order to make this decision. In a future post, we will debate the impact of the different choices on search advertising.

-

LinkedIn's Business →

Lately, I have been reading about several businesses and trying to understand their product offerings, value proposition of the products, business model and how they came to be. With a natural inclination for technology products and a curiosity about startups and business models, this has been an enjoyable learning experience and I am hoping to share a lot of my learning through this medium. Let’s start with LinkedIn.

LinkedIn’s Vision

Create economic opportunity for every member of the global workforce.

- I liked the simple and clear vision statement but was wondering why it mentions only economic opportunity while LinkedIn’s products offer much more or could it be the case that all the benefits the products offer can be tied to economic opportunity? I started researching about what this term economic opportunity entails and found this answer in Quora:

-

When somebody is willing to pay you money for doing something that you are willing and able to do, that is an “economic opportunity”. It can be a small business idea or a job.If you can produce a product or provide a service that people are willing to pay for, that is a small business opportunity. If you have an ability or skill that an employer needs, that is a job opportunity.

-

Basically, an economic opportunity is the chance to do work that somebody is willing to pay you for. You don’t have to “like” the work. You just have to be able to competently do it. If you like your work, all the better for you. But we work to earn money that is paid by other people. The work we do is for other people’s benefit. The money they pay us is for our benefit. It is a reciprocal pay-earn, demand-supply economic relationship. They pay us money for supplying them what they want.

I, however, feel that LinkedIn also provides knowledge opportunity (learning), business/marketing opportunity (sales leads) and career opportunity (jobs for professionals) and talent development (hiring solutions for recruiters) opportunity, etc. There might be some or some aspects of these on which you cannot really put a dollar value on in order for them to be called an economic opportunity.

LinkedIn’s Mission

The mission of LinkedIn is simple: connect the world’s professionals to make them more productive and successful.

Again, a short and crisp mission statement. But, again I believe that the main benefit is making professionals more skilled, equipped, informed, etc., rather than just productive.

LinkedIn’s Products

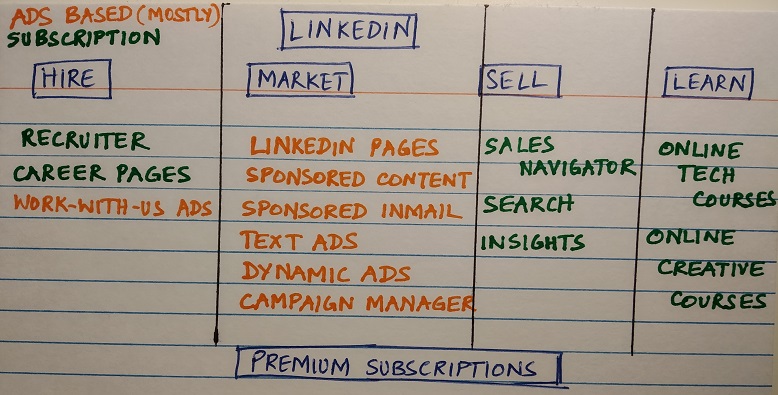

LinkedIn to many is just a networking site for professionals. But once you look at the suite of products it is much more than that. LinkedIn’s products are organized under four themes:

- Hire

- Market

- Sell

- Learn

The various products under each of these themes are shown below:

It is difficult to categorize each of the products into advertisement-based or subscription-based one as some of them overlap both business models. The HIRE theme is mainly for human resources professionals to track, follow, and manage recruiting pipeline for their organizations. I believe this could be one of the most active products (along with learning) on the platform. The MARKET theme helps in setting up marketing campaigns, reach out to potential resources for marketing purposes, set up custom pages, and serve advertisements on the pages and possibly through emails. Although it sounds like a lot of features, I believe they would have a very stiff competition from the likes of Google and Facebook. Although the advertisements would be more relevant to hiring and professional marketing, the eyeballs on these wouldn’t be as much as on Google search and Facebook feeds. However, with the volume of professionals in the network, hiring ads would get the best reach on this platform. The SELL theme sounds like a specialized Salesforce platform. The LEARN theme is an upcoming Coursera. Although it may not offer a wide variety of specializations for now, with data from the HIRE theme, it would be a more powerful medium for specialized skill development targeted at specific job roles in specific industries. We need to wait and watch how well Microsoft uses the data from one to better the offerings of another. Although LinkedIn membership is free, there is also a premium subscription which could be considered as a separate product in itself (creating significant revenue) and it is needed to use several of the other products, for example InMail.

LinkedIn’s business

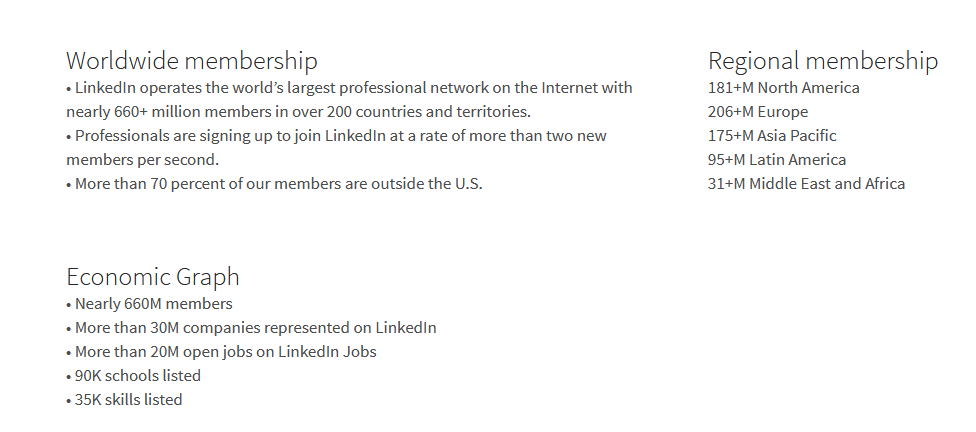

- LinkedIn has become a significant business unit of Microsoft. According to a source

-

In the 2019 fiscal year, LinkedIn brought in $6.8 billion worth of revenue, contributing to $38.1 billion of commercial cloud revenue for Microsoft, which in turn made up part of $126 billion total revenue.

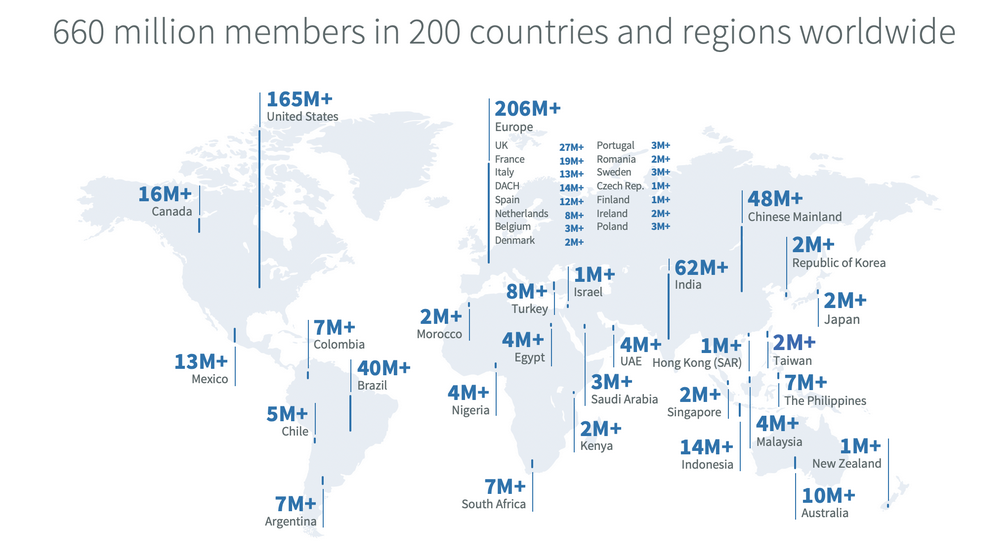

Further the numbers below from Microsoft’s earnings and LinkedIn newsroom validate the importance of LinkedIn and its potential.

LinkedIn’s Opportunity

And that shows the opportunity for LinkedIn. Along with the above, GitHub - the world’s largest software development platform or the playground for developers was snapped up by Microsoft. This indicates a very huge potential. The data from HIRE theme above combined with LEARN theme and fueled by GitHub platform is a wonderful growth opportunity. GitHub + LinkedIn for developers would be Instagram for fashionistas and for businesses and recruiters this would be the Instagram for fashion brands seeking ambassadors and influencers. Probably some day very soon let me write about the opportunity for data science and AI in stitching all the above products together as one awesome fabric.

Thats all for now!